Leading Debt Consultant Singapore: Specialist Services for Debt Resolution

Wiki Article

Check Out the Comprehensive Solutions Supplied by Debt Specialist Solutions to Help Households and individuals Accomplish Financial obligation Recovery Success

The monetary landscape for family members and people grappling with financial obligation can be daunting, yet debt specialist services offer a structured method to navigate this complexity. By providing customized monetary assessments, tailored budgeting strategies, and adept financial institution arrangement strategies, these solutions satisfy unique situations and challenges. Furthermore, customers benefit from continuous assistance and academic resources that empower them to keep lasting financial health. As we check out the detailed remedies provided by these specialists, it becomes vital to consider just how they can change a challenging economic circumstance into a manageable recuperation strategy.Recognizing Financial Obligation Professional Solutions

Financial debt consultant services play a critical role in assisting people and companies browse the intricacies of monetary responsibilities. These services give expert support and assistance customized to the unique monetary circumstances of customers. By reviewing the total economic landscape, debt specialists can determine the underlying concerns adding to debt buildup, such as high-interest prices, inadequate budgeting, or unanticipated expenditures.

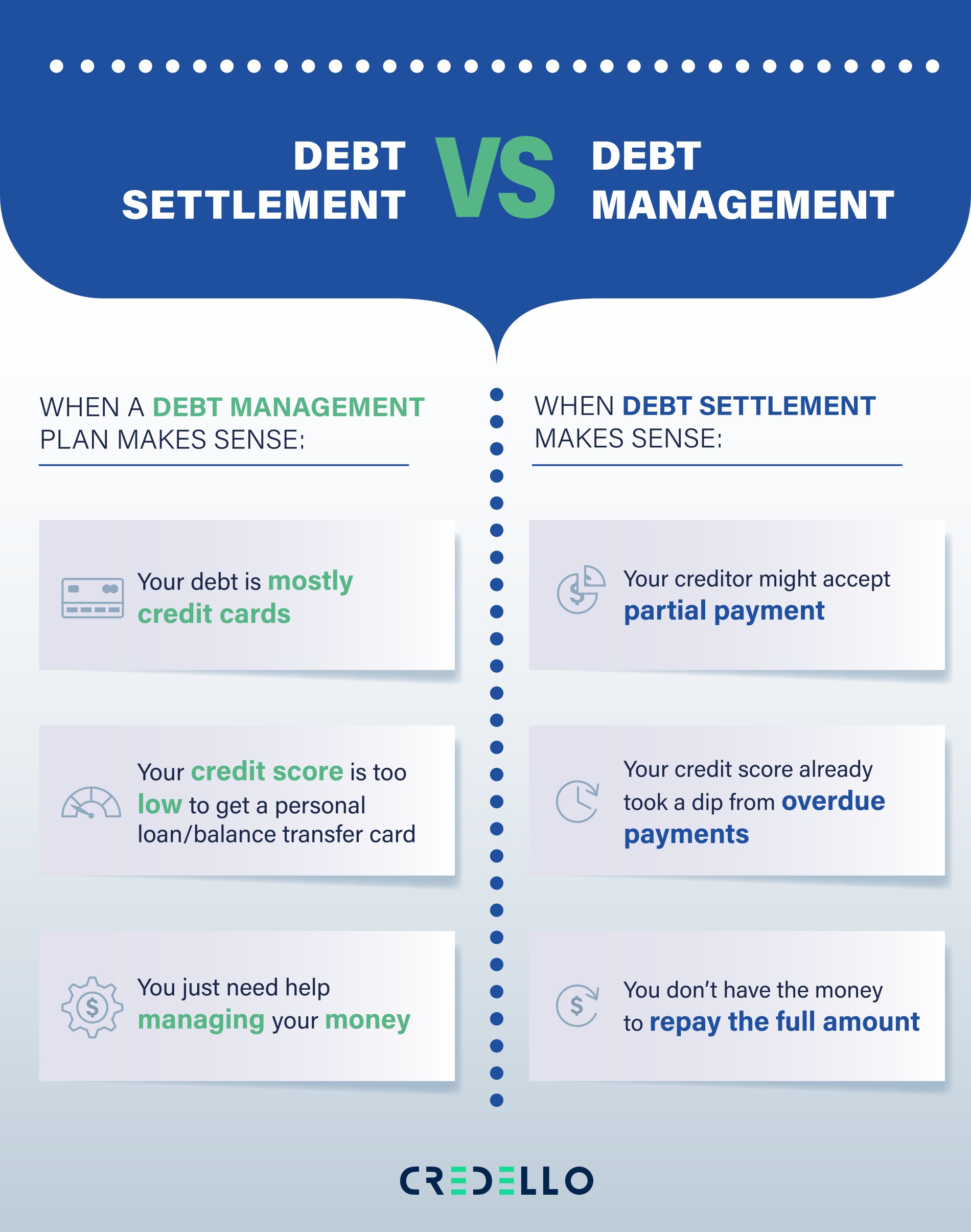

A key function of financial debt professionals is to enlighten customers concerning their choices for managing and minimizing financial obligation. This may include working out with creditors to secure much more beneficial terms or exploring debt consolidation methods to simplify payments. Moreover, experts equip clients with the understanding needed to make educated financial choices, promoting a deeper understanding of financial debt monitoring concepts.

The experience supplied by financial obligation specialists extends beyond simple debt reduction; they likewise play a necessary duty in developing lasting monetary practices. By instilling discipline and promoting liable spending behaviors, these experts assist clients construct a solid foundation for future monetary security. Inevitably, financial debt expert services work as a vital source for organizations and individuals looking for to restore control over their economic health and achieve lasting financial obligation recovery success.

Personalized Financial Analyses

An extensive understanding of a client's economic situation is essential to reliable debt monitoring, and customized economic analyses are at the core of this process (contact us now). These evaluations offer a thorough overview of an individual's or household's economic landscape, incorporating earnings, assets, liabilities, and expenses. By examining these essential elements, debt consultants can identify the distinct obstacles and opportunities that each client facesDuring a customized financial assessment, specialists engage in comprehensive discussions with clients to gather significant information about their financial actions, objectives, and worries. This information is then analyzed to create a clear picture of the client's present monetary health and wellness. The process frequently involves reviewing spending behaviors, recognizing unneeded expenditures, and determining the effect of existing financial obligations on overall financial security.

Moreover, customized financial assessments allow experts to identify possible locations for improvement and establish sensible monetary objectives. By tailoring their method to every customer's specific scenarios, debt consultants can develop actionable techniques that line up with the client's goals. Eventually, these analyses work as a vital starting factor for reliable debt healing, preparing for educated decision-making and sustainable economic administration.

Custom-made Budgeting Approaches

Reliable economic administration hinges on the execution of tailored budgeting approaches that accommodate individual needs and conditions. These strategies are important for individuals and families making every effort to restore control over their monetary circumstances. A one-size-fits-all method commonly falls brief, as everyone's monetary landscape is one-of-a-kind, influenced by earnings, expenses, debts, and individual objectives.Debt consultant services click for more play a pivotal role in developing tailored budgeting plans. At first, consultants conduct extensive evaluations to determine revenue resources and categorize costs, comparing discretionary and important costs. This enables clients to identify locations where they can decrease prices and assign even more funds toward financial debt payment.

On top of that, customized budgeting strategies integrate reasonable monetary objectives, assisting clients established achievable targets. These Clicking Here goals foster a sense of accountability and inspiration, important for preserving commitment to the budget. Recurring support and regular evaluations make certain that the budgeting strategy continues to be relevant, adjusting to any kind of adjustments in economic scenarios or personal priorities.

Inevitably, personalized budgeting methods encourage individuals and households to take proactive actions towards debt recovery, laying a strong foundation for lasting financial security and success.

Financial Institution Negotiation Techniques

Working out with creditors can considerably minimize monetary burdens and lead the method for even more convenient repayment strategies. Effective financial institution arrangement techniques can encourage individuals and households to attain considerable debt alleviation without considering insolvency.One essential technique is to clearly understand the economic circumstance prior to launching call. This consists of gathering all pertinent info concerning financial debts, passion rates, and repayment histories. With this data, the borrower can present a compelling situation for settlement, highlighting their willingness to pay back while stressing the obstacles they encounter.

An additional strategy entails proposing a practical settlement plan. Using a lump-sum payment for a lowered total equilibrium can be appealing to creditors. Conversely, recommending lower regular monthly settlements with extended terms may aid ease capital problems.

Additionally, maintaining a tranquil and respectful disposition during settlements can foster a participating environment. Creditors are more probable to take into consideration propositions when come close to with professionalism and politeness.

Continuous Support and Resources

Ongoing support and sources play a vital role in aiding individuals navigate their monetary recovery trip post-negotiation. After successfully negotiating with creditors, clients typically call for additional advice to keep their newly restored economic stability. Financial obligation consultant services supply constant assistance with different methods, ensuring that individuals stay on the right track toward attaining their financial objectives.

Furthermore, several financial debt consultants offer personalized follow-up appointments, enabling clients to obtain and discuss recurring difficulties tailored recommendations. This ongoing connection helps customers stay determined and liable as they work towards long-term financial recovery.

Additionally, access to online devices and resources, such as budgeting applications and credit score monitoring solutions, enhances clients' capacity to handle their financial resources effectively - contact us now. By incorporating education, tailored support, and functional tools, financial debt specialist solutions encourage families and people to achieve and maintain long-term financial healing

Verdict

Via tailored economic evaluations, tailored budgeting approaches, and specialist financial institution settlement methods, these services properly resolve unique financial obstacles. The detailed options provided by debt professionals inevitably foster financial stability and liable spending habits, paving the means for a much more protected financial future.

Report this wiki page